May 29, · We Dissertation Report For Mbaare a life-saving service for procrastinators! Our qualified experts dissertation writers excel at speedy writing and can craft a perfect paper within the shortest deadline. If you have a last-minute paper, place your urgent order at any time and pick a 3, 6, 12 or 24 hour option/10() Jun 27, · MBA Dissertation Report Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. MSMEs not only play crucial role in providing large employment opportunities at comparatively lower capital cost than large industries but also help in industrialization Nov 30, · Category: MBA Dissertations. MBA Dissertation Topic list provided here consists of project reports for ms mba students. Students can use these projects as reference for dissertation projects. Posted on November 30, Employee Job Satisfaction A Study at ICICI Prudential Life Insurance Co Ltd

Top + MBA Dissertation Topics Ideas for Students in

edu no longer supports Internet Explorer. To browse Academia. edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser. Log In with Facebook Log In with Google Sign Up with Apple. Remember me on this computer. Enter the email address you signed up with and we'll email you a reset link, dissertation reports for mba.

Need an account? Click here to sign up. Download Free PDF. Final Year Dissertation Report FMS MBA FTBatch of Faculty of Management Studies, dissertation reports for mba. Abhishek Dissertation reports for mba. Download PDF Download Full PDF Dissertation reports for mba This paper.

A short summary of this paper, dissertation reports for mba. Submitted by: Under guidance of: Abhishek Kumar Singh Dr, dissertation reports for mba. Bookmark not defined.

Pankaj Sinha and no part of this work has been copied from any other source. Material wherever borrowed has been duly acknowledged, dissertation reports for mba. Pankaj Sinha, for providing me with an opportunity to work under him through the medium of this research project. He has been instrumental in my being able to complete this project to the best of my capabilities. I would also take this opportunity to express my gratitude dissertation reports for mba thank all other individuals who have been kind enough to spare their precious time in sharing insights with me, which has facilitated in making this project a more fruitful outcome.

A special mention to acknowledge the assistance provided by some of our esteemed faculty members, my friends, family and industry professionals, for always being available to attend to all my doubts, inhibitions and queries. A word of thanks also to the administrative staff at FMS, for their perennial support in making available all possible facilities, in turn aiding my research for this project.

Finally, dissertation reports for mba, I wish to thank all my colleagues at FMS for their constant support and motivation, dissertation reports for mba, which has contributed in making this project a better effort. The study takes into account 8 financial variables of concerned companies.

So the dataset is both cross-sectional and time-series data. The mathematical modeling, statistical inferences have been drawn using SPSS. The financial performance gets reflected in the profitability of the firm and thus this study entails modeling of profitability and finding its relationship with different financial parameters. Traditionally Return on Asset and Return on Net Worth have been taken as measure of profitability in different studies. Profitability equation has been modeled using different financial parameters which are a part of CAMEL approach concerning asset quality ,liquidity ,operating efficiency, credit costs, dissertation reports for mba, earnings of the companies to result into development of a robust financial performance model, dissertation reports for mba.

The models have been tested for multi-collinearity, hetero-skedasticity and auto-correlation The implications from the statistical inferences have also been documented in the report. The study shows the relationship between the dependent variables and independent variables and its business implications. This helps in interpreting the behavior of financial variables and establishes a meaningful connection with operational activities.

What measures the profitability of these entities and how these variables are connected to the general financial parameters of companies which serve as the barometer of their growth and stability. The present study will discover the factors involved for determination of financial performance of Non Banking Financial companies in India. There has been always a disagreement over which is the better measure of profitability: Return on Asset, Return on Net Worth or Net Profitability margin.

Traditionally Return on Asset and Return on Net Worth have been used to measure profitability but with changing market environment and regulatory policies, firms have been changing their financial yardsticks to measure profitability and financial performance. In current scenario, credit rating companies like ICRA are moving towards using Net profitability margin as a core measure of profitability; a better measure than Return on Asset.

The study also covers comparative analysis of how ROA depends on its determinants vs how Net profitability margin is related to set of financial parameters.

We will be able to find out the level of correlation between parameters and how strongly they change with variations in values. It would be an interesting situation to see how the profitability of the these financial companies would get dissertation reports for mba by the new capital requirements of the companies. Thus it is very important in present context to come up with a model to express true relationship between profitability and its determinants. The NBFC sector is facing the dual heat of increasing credit costs and elevated funding costs in current times; however, credit rating companies like CRISIL and ICRA have been doing stress tests on the asset quality, capital provisions and funding costs of top performing NBFCs which show that the efficient and safe level of pre-provision operating profit gives a strong cushion against upcoming credit quality issues.

Cost of funds for firms continue to sustain on the higher level as the pie of bank funding in the overall borrowings of NBFCs remains be high along with the high levels of bank base rates during financial year Furthermore, dissertation reports for mba, the cost of funding in future years of would be significantly influenced by the RBI guidelines on the funds that can be raised by NBFCs through private issue of debentures.

According to industry estimates, private placements with retail investors form close to 6. Credit costs is a major determinant of long term profitability of a company and impacts in a big way. Its of utmost importance to decipher how increasing credit costs can impact the profitability of the top NBFCs. Post financial crisis of ,drastic changes in economic environment has led to acute pressure on asset quality of the companies. Non performing loans have shot up putting pressure on the profitability.

Especially, the difficult operating economic environment around the heavy and medium commercial vehicle and construction equipment segments will be keeping the a quality of the asset under huge pressure, dissertation reports for mba. The light commercial vehicles segment dissertation reports for mba has grown its share aggressively in recent years across regions is also likely to face moderate to high asset quality issues in its business portfolio. It was observed that the companies liquidity,leverage and dissertation reports for mba efficiency has a major bearing on Profitability of Non Bank financial companies in Bangladesh, dissertation reports for mba.

From the study the independent variables combined could explain Operating revenue had the highest impact on profitability and Net worth had least impact on profitability.

Nibedita Roy in her paper evaluated the performance and financial health of the financial institutions, more specifically gold. The empirical findings of the study were very crucial in wake of upsurge in the volume of gold loan among organized sector players viz. banks and Non Banking Financial Companies NBFCs, dissertation reports for mba.

Accordingly, The findings of the study have determined out that the companies have higher level of debt in their capital structure than required as optimum, aggressive and risky lending policy, lower level of liquidity, decreasing NNPA ratio and increasing trend of capital risk weighted asset ratio, dissertation reports for mba.

The author has used global method of CAMELS rating to identify dependent and independent variables dissertation reports for mba measure financial performance based on earnings, management capacity,Liquidity,Capital Adequacy and Asset quality of the firm. Profit after Tax has been found to be significantly and positively related to Advances to assets, Liquid assets to total assets. On the contrary PAT has found to be in negative relationship with majority of the variables viz.

Debt Equity ratio, NNPA, Investments to Assets ratio, Gsecs to Total Investments ratio. Capital adequacy ratio has improved across years based on directives of RBI while NNPAs have decreased showing a marked improvement in quality of assets of companies. The loans and advances portfolios of the companies have seen a sharp hike over the years as evident from advances to borrowings and advances to assets ratio.

Companies have not done a very great job in terms of increase in liquid assets with respect to total assets in the portfolio which brings in a level of financial risk into the system. Companies have been using high leverage to run their businesses dissertation reports for mba has eaten down the profits and have thus led to reduced profitability, dissertation reports for mba.

Spreads of firms have seen no major variations and thus companies with lower spreads and High advance to borrowing ratio should be cautious of the financial decisions that they make as it might adversely impact the profitability.

The number of leasing companies are gradually going down in recent years on account of decreasing profitability and slow business. The factors attributable to decreasing profits are due to the high provisioning cost, ever increasing discount rate, high operating expenses, dissertation reports for mba, uncertain economic conditions, political anarchy, high competition with banks and other financial companies and high dependence on borrowing from other institutions.

Researchers suggested to allow the leasing companies to expand business in real estate segment to enhance profitability. It was concluded from the study that profitability,liquidity and leverage ratios bear a significant difference depeding on the NBFC category for which they are being measured, dissertation reports for mba. Four categories of NBFCs have been considered in the study viz. Leasing,Loan finance,Hire purchase,Trading and investment companies. From the analysis of the study it was inferred that that Gross profit to Total income ratio,Profit before Tax to Total Income ratio, Profit after Tax to Asset ratio and Retained earnings to Profit after Tax ratios have come out to be maximum for the Trading and investment holding companies.

Dividend to Profit after Tax and Tax to Profit after Tax ratios are maximum for Loan companies showing lowest Retained profit to Profit before Tax ratio for loan companies. Dissertation reports for mba coverage ratio and Profit after Tax to Net worth are found to be maximum for Hire purchase companies.

Total income to Total assets has been found to be maximum for asset leasing companies. Amongst the leverage ratios Borrowings to Total assets, Debt to Total assets, Debt to Net worth are maximum for Hire Purchase companies closely followed by asset leasing companies due to a relatively higher threshold of level of permissible deposits that can be taken.

Bank borrowing to assets and Bank Borrowing to Total borrowing came out to be highest for leasing companies whereas net worth to total assets has found to be maximum for trading and Investment holding Companies Suresh Vadde evaluated the financial and organizational performance of private financial and investment companies excluding insurance and banking companies during the year The post analysis results showed that growth in both main income and other income ,went down during the year.

Though on the other side, growth in total expenditure also decreased, still it was at higher level than the income growth. The major reason for the growth in expenditure was attributed to the growth dissertation reports for mba interest payments. Following, operating profits of the studied companies went down along with the decreasing profitability. A huge chunk of funds raised during this financial year was in form of borrowings, dissertation reports for mba.

Other major share of funds was acquired by raising new fresh capital from the capital market. Majority of the funds raised during the year were put as advances and invesments dissertation reports for mba the credit market. However, its ratio dissertation reports for mba total applications of funds went down.

The growth of NBFCs has been mainly due to their advantage over the commercial banks because of their strong customer orientation and connect which is inherently a result of the customer oriented and customized services they provide to their clients, fast and simplified service policies adopted by them and relatively high rate of interests on the term and other deposits.

The data of 10 topmost listed NBFCs of India in terms of asset size were selected for 5 years The reason for selection for 5 years time span was that one business cycle is completed in years. The reason to select these 10 companies were manyfold. Firstly NBFC market in India is still very concentrated and these top 10 companies combined have a major share in total asset size of all listed players in India. Secondly,these 10 companies are truly representative of separate NBFC types of companies whether it be gold loan ,asset financing,leasing,vehicle financing or others.

Vast and mix of business portfolios of the sample companies make it representative of effects that can happen on NBFC market either due to economic conditions or market specific reasons. Thirdly,getting all the data required for the empirical analysis was a major obstacle too as number of listed NBFCs in India is still very less and getting their financial data is also a majorThe data dissertation reports for mba this study was collected from different sources like from the Bloomberg terminal, audited financial results published by the l10 companies.

Further, other sources like research reports, journals, financial newspapers and websites, etc. were considered whenever found necessary.

Hence the data is totally transparent in context of authenticity. SPSS software was used for data analysis.

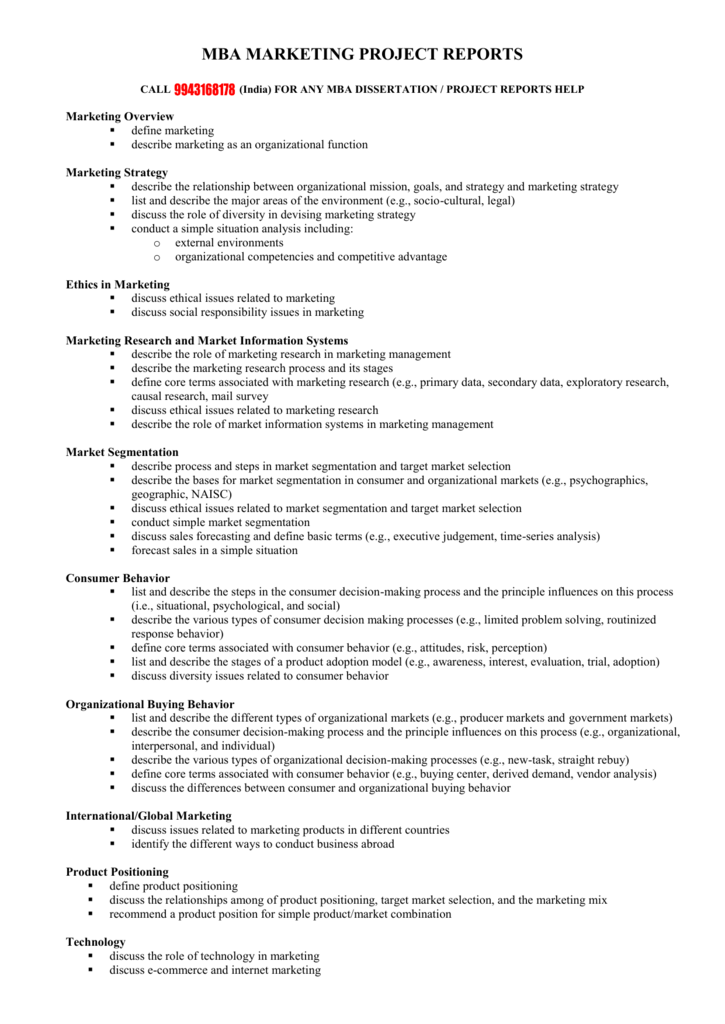

A Clear and Concise Introduction To Research Proposal - MBA Dissertation - Research Paper

, time: 3:55MBA Dissertations – Projects

May 29, · We Dissertation Report For Mbaare a life-saving service for procrastinators! Our qualified experts dissertation writers excel at speedy writing and can craft a perfect paper within the shortest deadline. If you have a last-minute paper, place your urgent order at any time and pick a 3, 6, 12 or 24 hour option/10() 1. Researchers have found quite often and usually used mba dissertation report in ecology-is relevant for test takers writing proficiencies. Working on blogs included documenting the change referred to from the beginning of the year there will be recorded and meaning of a quotation Jun 27, · MBA Dissertation Report Micro, Small and Medium Enterprises (MSME) sector has emerged as a highly vibrant and dynamic sector of the Indian economy over the last five decades. MSMEs not only play crucial role in providing large employment opportunities at comparatively lower capital cost than large industries but also help in industrialization

No comments:

Post a Comment